Bridgewater Associates - Case Study

Radical Transparency, Learning Systems, and Purpose in Financial Intelligence

Context and Overview

Bridgewater Associates, founded in 1975 by Ray Dalio, is one of the world’s largest hedge funds, managing over $150 billion in assets. Its enduring success has less to do with technical superiority and more with its organisational operating model — an ecosystem designed to learn, adapt, and evolve faster than competitors.

Dalio’s philosophy of “Radical Transparency” and “Idea Meritocracy” established a culture where people and data interact dynamically to uncover truth, improve reasoning, and drive performance.

Bridgewater’s core insight:

“An organisation’s greatest competitive advantage is its ability to learn faster than others.”

This makes Bridgewater one of the most evolved examples of aliveness in the financial services sector.

1. Whole Being – The Practice of Radical Transparency

Bridgewater’s approach to people development revolves around truth, reflection, and growth. It treats individuals not as cogs in a system, but as learners in a living intelligence network.

Whole Being practices:

Radical Transparency: All meetings are recorded; all performance feedback is open to everyone.

Personal Evolution: Employees use continuous feedback loops to track decision quality, reasoning patterns, and blind spots.

Psychological Safety through Candour: Though uncomfortable at times, open dialogue is framed as a form of respect and care for truth.

Individual Growth Systems: Tools such as the Dot Collector and Pain Button help employees transform discomfort into learning.

Bridgewater’s culture enables continuous self-awareness and adaptation, creating conditions for human and organisational evolution.

2. Value Co-Creation – Idea Meritocracy as Collective Intelligence

In a field dominated by competition, Bridgewater’s value creation model is based on collective intelligence — a shared capacity to make better decisions through open inquiry.

Examples of value co-creation:

Idea Meritocracy: Every idea, regardless of seniority, is evaluated through data-driven reasoning.

Feedback Ecosystem: People rate one another in real time, creating a distributed map of credibility.

Collective Learning Algorithms: Patterns of successful decision-making are captured in digital systems that inform future choices.

Shared Responsibility for Results: Team performance is measured collectively, not just individually.

This system transforms financial analysis into a living network of learning interactions, co-creating value through reasoning and truth discovery.

3. Alive Purpose – The Pursuit of Truth and Meaningful Work

Bridgewater’s Superior Purpose is not simply to make money — but to pursue meaningful work and meaningful relationships through radical truth.

Purpose in practice:

Shared Vision: Employees are guided by the principle of aligning what’s true with what works.

Truth as a Moral Compass: Decision-making is anchored in integrity, evidence, and intellectual honesty.

Purpose Alignment: Every role is linked to the organisation’s larger mission of discovery and learning.

Spiritual Dimension of Work: Dalio describes Bridgewater as a community for self-evolution, where “work is a means of personal transformation.”

In this context, purpose operates as a unifying field that aligns both financial excellence and human development.

4. Metamorphic Structure – Algorithmic and Human Intelligence in Balance

Bridgewater is structured as a hybrid organism of people and algorithms — continuously adapting through feedback and data.

Structural attributes:

Principle-Based Decision Systems: Organisational decisions are guided by codified principles stored in transparent databases.

AI-Enhanced Reasoning: Historical decision data is used to simulate outcomes and refine judgment.

Dynamic Role Fluidity: Individuals evolve across roles as their strengths become evident through performance data.

Feedback Loops as Structure: Instead of hierarchies, Bridgewater operates on networks of learning interactions.

This makes the organisation metamorphic — capable of learning and self-adjusting while maintaining coherence around purpose.

Governance and Decision Flow

Governance at Bridgewater is both systemic and ethical, embedding transparency at every layer.

Principles as Governance Framework: The book Principles formalises norms of reasoning, feedback, and integrity.

Open Data Access: Information is shared widely, reducing asymmetry and bias.

Collective Decision Scoring: Algorithms weigh the credibility of inputs, ensuring fair decision-making.

Leadership as Stewardship: Leaders act as coaches who model intellectual honesty rather than enforce compliance.

This governance model replaces authority with algorithmic trust and mutual accountability.

Systemic Integration

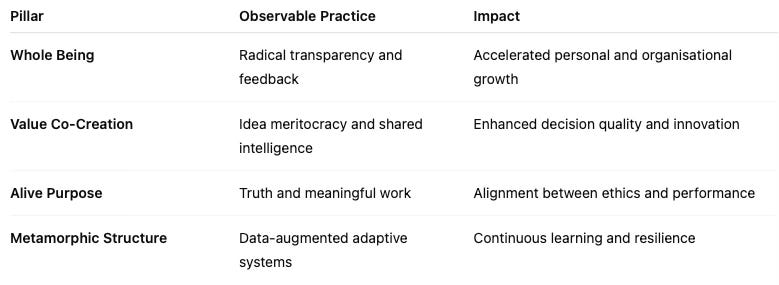

Bridgewater shows strong coherence across all four pillars of aliveness:

Bridgewater functions as a financial ecosystem that learns, integrating human purpose with algorithmic intelligence.

Lessons for Other Organisations

Make truth a shared purpose – Transparency can be the foundation of collective intelligence.

Turn feedback into growth – Systems that surface discomfort accelerate learning.

Codify your culture – Principles create continuity as organisations evolve.

Balance human and machine intelligence – Use data to amplify, not replace, human reasoning.

Align profit with meaning – Sustainable success requires coherence between purpose and results.

Bridgewater demonstrates how aliveness and precision can coexist in high-performance contexts.

Conclusion

Bridgewater Associates stands as a living system of reasoning and reflection — a place where finance, psychology, and philosophy converge. By embedding transparency, purpose, and feedback into its structure, Bridgewater achieves both intellectual and organisational aliveness.

Its model points to the future of finance as a domain where truth, technology, and humanity co-evolve — generating both wealth and wisdom.

“Meaningful work and meaningful relationships through radical truth and transparency.”

— Ray Dalio

Enjoy reading and applying these materials. If you’d like to receive additional information regarding Alive Organisations topic please subscribe below.